Managing personal finances can be daunting, but if you have a budgeting software, it can be done easily.

At AccelerateDigitally, we provide you with all the information you need to manage money effectively. If you want to manage your finances effectively, having a personal software tool is necessary.

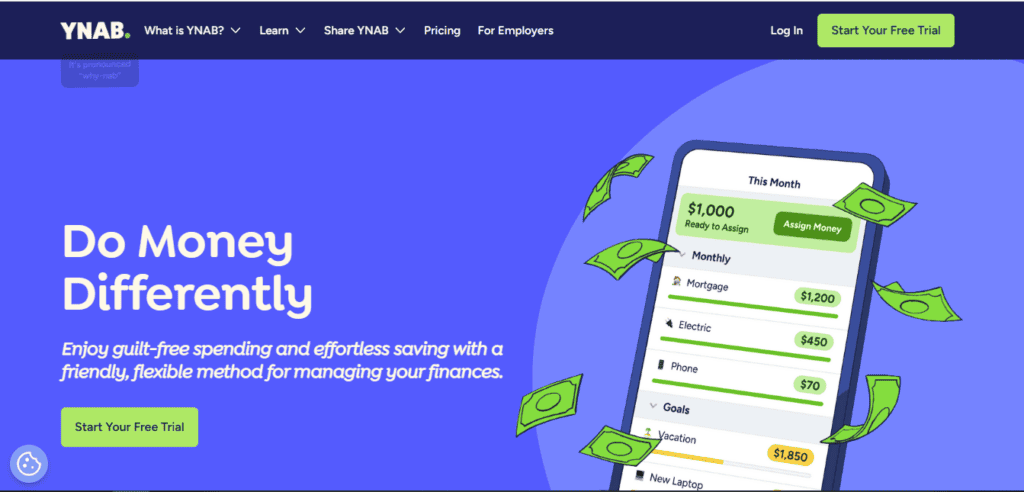

1. YNAB (You Need A Budget) – Best for regular money management

Free Trial: Yes

Cost: $14.99/month or $109/year.

Overview

YNAB is a budgeting software that primarily focuses on helping its users gain control of their money. As you create your budget, this software provides you with a tutorial that will help you clarify tougher financial topics while managing finances.

YNAB can even help you break bad financial habits by integrating finance management rules.

It comes with a unique “Zero-based budgeting” feature, allowing users to allocate every dollar to a specific category thus helping its users allocate their income effectively.

This software can automatically be linked to your bank account so that you can track your budget properly. By tracking your budget, you can find out whether you are overspending or not. If so, you can take the appropriate action.

Key Features:

- Real-time syncing across devices

- Goal tracking and progress reports

- Detailed spending and income reports

- Educational resources and support

Pros:

- User-friendly interface

- Strong focus on financial education

- Excellent customer support and educational material

- Account sharing up to six people

Cons:

- Subscription-based pricing

- Requires a learning curve

Why We Picked It

It is on top of our list because the software is built on the philosophy of financial responsibility and diligence.

2. Intuit TurboTax – Best for Taxes

Free Trial: No

Cost: Free version (for simple tax returns only), Paid options starting at $89

Overview

Intuit TurboTax is the most popular tax preparation software today. It simplifies the tax filing process and provides accessibility even for people who are not tax experts.

You may not need TurboTax during the financial year for managing finances, but when tax time comes, this software becomes handy. In the basic version, you can file state and federal returns for free if all you use is Form 1040 with no attached schedules. For entering tax information, you can import W-2 information from your employer, and then the software will automatically transfer into the form.

Turbotax allows you to connect with tax experts to give you personalized advice on the returns.

Key Features:

- Provides a step-by-step approach to tax filing

- Users can import their W-2, 1099, and other tax documents

- Offers support via phone, email, and chat

Pros:

- Ease of Use

- Comprehensive Coverage

- Security

Cons:

- Cost

- TurboTax often tries to upsell additional services and products that may not be necessary

Why We Picked It

It helps the user in filing their tax returns. It helps take the headache of filing tax returns out of the process.

3. Quicken– Best for Personal Budget

Free Trial Available: No

Cost: $47.88/year and up

Overview

Quicken is a full-featured software that offers a wide range of features for personal finance management. It provides tools for budgeting, investment tracking, and bill management.

Through this software, you can create a budget, track debt, and set savings goals. You can pay bills directly through the Quicken software. This software not only manages your personal finances but also helps in managing and tracking business expenses, rental payments, investments, etc.

Quicken offers a 30-day money-back guarantee. The software starts at $47.88 per year and is available for almost all operating systems: Windows, MacOS, iOS, and Android.

Key Features:

- Comprehensive budgeting tools

- Investment tracking and analysis

- Bill management and payment reminders

- Customizable reports and charts

Pros:

- Robust feature set

- Long-standing reputation

- Available for both Windows and Mac

Cons:

- Higher cost compared to other options

- Can be overwhelming for beginners

Why We Picked It

Quicken is a full-fledged software that gives you the facility of personal finance management at a low cost.

4. Empower (Formerly Personal Capital) – Best for Investment Advice

Free Trial: No

Cost: Budgeting tool is free. Wealth management costs 0.89% on the first $1 million of the balance.

Overview

Empower (formerly Personal Capital) offers both investing and budgeting tools to let you manage everyday spending and setting long-term financial goals. This tool is a comprehensive financial management platform designed to help users take control of their finances. It offers a range of tools for budgeting, expense tracking, and investment management, all in one place.

Key Features:

- Budgeting and cash flow tracking

- Investment tracking and analysis

- Retirement planning tools

- Net worth tracking

Pros:

- Comprehensive financial planning tools

- Integration with various financial accounts

Cons:

- Focus on investment management may not appeal to everyone

- Limited budgeting features compared to other options

Why We Picked It

With Empower, you get a package of budgeting and investing tools that help you reach your financial goals

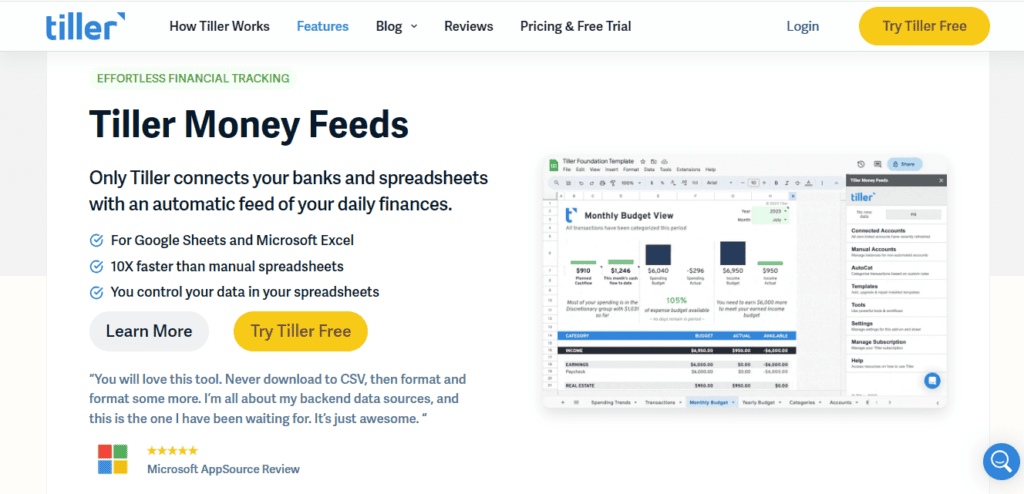

5. Tiller Money – Best for Spreadsheet Management

Free Trial: Yes, 30 days free-trial

Cost: $79/year

Overview

Tiller Money is a budgeting software that can be integrated with Excel Sheets and Google Sheets to compile all your financial data such as investment, credit card, loan, etc. into one place. It also offers customizable templates for finance planning, budgeting, and expense tracking.

The service costs $79 per year but you can try a free trial for 30 days to see if it’s right for you.

Key Features:

- Automatic transaction import

- Customizable budgeting templates

- Detailed financial reports

- Integration with Google Sheets and Excel

Pros:

- Highly customizable

- Strong focus on data privacy

- Excellent customer support

Cons:

- Requires knowledge of spreadsheets

- Subscription-based pricing

Why We Picked It

Tiller can be an ideal option for you if you want to take control of your personal finances and work together on budgeting goals.